Free Section 125 Plan Document Template

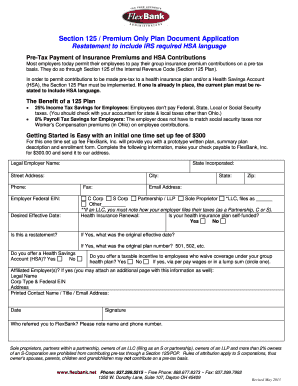

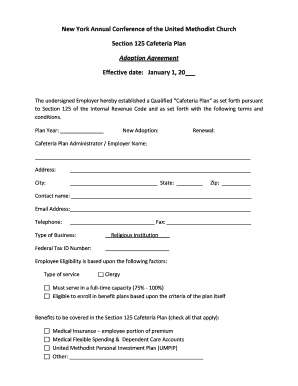

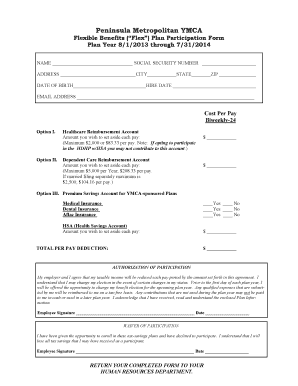

Free section 125 plan document template - Jason September 27 2021 wallpaper No Comments. Written Plan Document A Section 125 plan must be maintained pursuant to a written plan document that is adopted by the employer on or before the first day of the plan year. The statutory prohibition on. After all the whole point of setting up a Section 125 plan is to save money by eliminating income tax on insurance premiums. We Help You Stay In Compliance Many companies have a Section 125 POP plan document on file but it is out of date. As is the case with our sample cafeteria plan documents since past special enrollment rights had only a 30-day timeframe. To the extent provided in the Adoption Agreement the Plan provides for the pre-tax payment for employee portions of medical dental and vision premiums health saving. The Section 125 Premium Only Plan is part of the IRS Code that allows employees to purchase health insurance and other ancillary benefits tax free. Sample Plan Document. Ad Free Fill in Legal Templates.

The premium or HSA contribution is actually deducted before taxes are calculated. The plan document should be signed and kept on file. Section 125 cafeteria plan create your required section 125 cafeteria plan document with flexible spending account health savings account dependent care account pre tax premium deductions permitted in easy to follow steps strategic plan template free download cascade strategy the strategic plan template will help you to create all the elements of a strategic plan and by the end you will have a. The purpose of the plan is to allow employees the opportunity to elect to pay the portion of medical insurance premium costs for which they are responsible. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Section 125 Plan Document Template Fill Online Printable Fillable Blank Pdffiller

With a Section 125 POP plan each eligible employee is given the option to elect into a Salary Reduction Agreement with the employer in which he or she agrees to the amount of pre-tax salary to be witheld from wages for health care coverage. Because of differences in facts circumstances and the laws of the various states interested parties should consult their own attorneys. The plan document should be signed and kept on file.

Show ImageSection 125 Plan Document Requirements Fill Online Printable Fillable Blank Pdffiller

The plan document should be signed and kept on file. Premium Only Plan effective April 1 2014. A Flexible Benefit Plan also known as a Section 125 Plan is part of a cafeteria plan that allows employees to purchase certain benefits with pretax dollars.

Show ImageScgov Net

A cafeteria plan must have a plan year specified in the written plan document. Ad Simple Legal Solutions in the Comfort of Your Home. The premium or HSA contribution is actually deducted before taxes are calculated.

Show ImageQuitmanschools Org

Section 101 PLAN This document Basic Plan Document and its related Adoption Agreement are intended to qualify as a premium only cafeteria plan within the meaning of Code section 125 that provides for the pre-tax payment of premiums and to the extent provided in the Adoption Agreement pretax contributions to a Health Savings Account. Basic Business Plan Template 18 Free Pdf Format Download Free Premium Templates. Create a Personalized Legal Document in Minutes.

Show ImageFillable Online Fsa Reimbursement Claim Form Section 125 Cafeteria Plan Fax Email Print Pdffiller

Instantly Find Download Legal Forms Drafted by Attorneys for Your State. PREMIUM ONLY PLAN POP Plan It is the intent that this plan shall qualify as a Section 125 plan of IRC as amended from time to time. As is the case with our sample cafeteria plan documents since past special enrollment rights had only a 30-day timeframe.

Show ImageBeware Of Free Or Self Serve Section 125 Plan Documents Core Documents

After all the whole point of setting up a Section 125 plan is to save money by eliminating income tax on insurance premiums. A Flexible Benefit Plan also known as a Section 125 Plan is part of a cafeteria plan that allows employees to purchase certain benefits with pretax dollars. Step by Step in 5-10 Minutes.

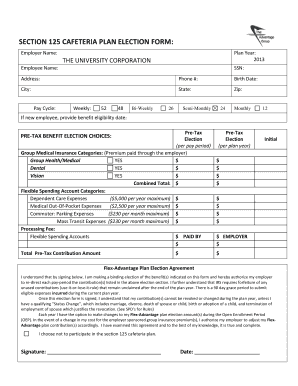

Show ImageFillable Online Csun Section 125 Cafeteria Plan Election Form California State Csun Fax Email Print Pdffiller

Written Plan Document A Section 125 plan must be maintained pursuant to a written plan document that is adopted by the employer on or before the first day of the plan year. To the extent provided in the Adoption Agreement the Plan provides for the pre-tax payment for employee portions of medical dental and vision premiums health saving. A Flexible Benefit Plan also known as a Section 125 Plan is part of a cafeteria plan that allows employees to purchase certain benefits with pretax dollars.

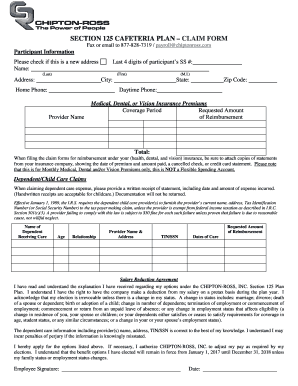

Show ImageFillable Online Section 125 Cafeteria Plan Claim Form Chipton Ross Fax Email Print Pdffiller

Legally Binding Contracts Online. Because of differences in facts circumstances and the laws of the various states interested parties should consult their own attorneys. Basic Business Plan Template 18 Free Pdf Format Download Free Premium Templates.

Show ImageScgov Net

In order to qualify for tax advantages a Section 125 plan must satisfy the requirements of Code Section 125 and underlying IRS as summarized below. The Plan is intended to qualify as a Cafeteria Plan under Section 125 of the Code so that Optional. Section 125 Plan Document Template.

Show ImageSample Section 125 Plan Document Fill And Sign Printable Template Online Us Legal Forms

FSA-Enrollment-Authorization Form This is a generic form call CPA Inc if you need information on your plan specs. Trusted by Over 10 Million People. Eflex a division of TASC has.

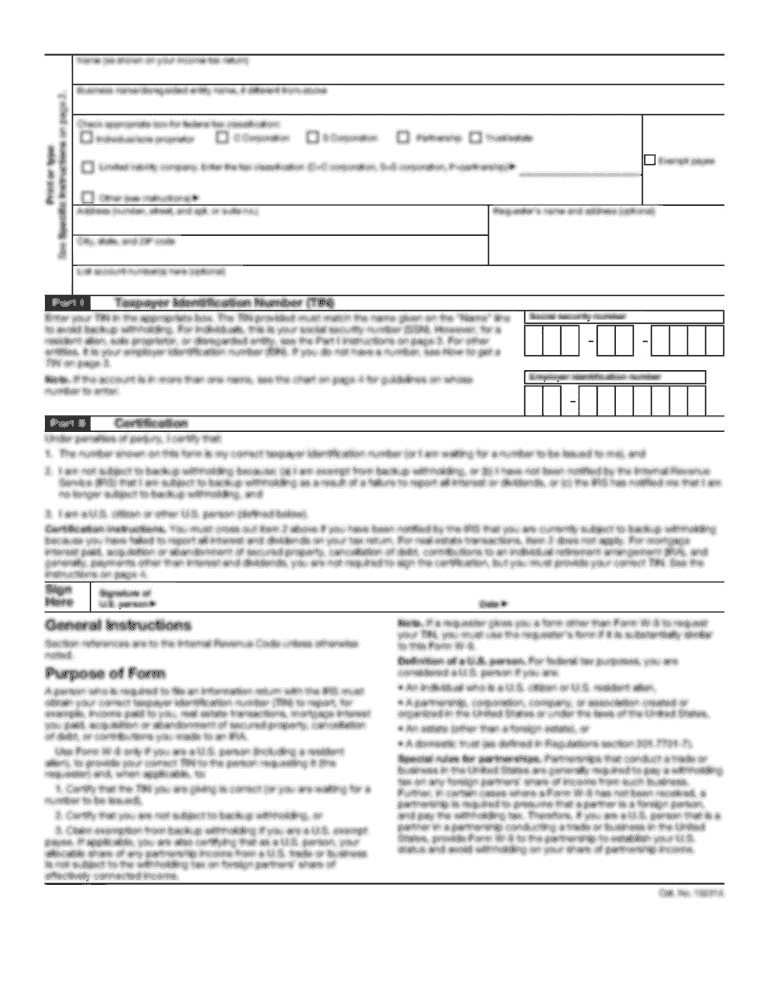

Show ImageThis sample form Section 125 Cafeteria Plan Summary Plan Document SPD is an important document which should be carefully considered in light of the Employers particular circumstances. Section 125d2A states that the term cafeteria plan does not include any plan which provides for deferred compensation. The purpose of the plan is to allow employees the opportunity to elect to pay the portion of medical insurance premium costs for which they are responsible either on a pre-salary reduction basis or. Federal law requires all employers to have a 125 Cafeteria Premium Only Plan POP document if offering tax free benefits to their employees. Ad The Leading Online Publisher of National and State-specific Legal Documents. Sample Plan Document. Because of differences in facts circumstances and the laws of the various states interested parties should consult their own attorneys. With a Section 125 POP plan each eligible employee is given the option to elect into a Salary Reduction Agreement with the employer in which he or she agrees to the amount of pre-tax salary to be witheld from wages for health care coverage. To the extent provided in the Adoption Agreement the Plan provides for the pre-tax payment for employee portions of medical dental and vision premiums health saving. These documents explain the rules of the plan.

Section 101 PLAN This document Basic Plan Document and its related Adoption Agreement are intended to qualify as a cafeteria plan within the meaning of Code section 125. Although most cafeteria plan documents include HIPAA special enrollment rights under Code Section 9801f many plans likely do not allow for a 60-day election period. Free 18 Individual Development Plan Examples Samples In Pdf Word Google Docs Pages Doc Examples. Section 125 cafeteria plan create your required section 125 cafeteria plan document with flexible spending account health savings account dependent care account pre tax premium deductions permitted in easy to follow steps strategic plan template free download cascade strategy the strategic plan template will help you to create all the elements of a strategic plan and by the end you will have a. Section 125 cafeteria plan create your required section 125 cafeteria plan document with flexible spending account health savings account dependent care account pre tax premium deductions permitted in easy to follow steps strategic plan template free download cascade strategy the strategic plan template will help you to create all the elements of a strategic plan and by the end you will have a. Section 12 Purpose The purpose of the Plan is to provide Participants with a choice between cash and certain qualified nontaxable benefits as defined in Section 125 of the Internal Revenue Code. The Section 125 Premium Only Plan is part of the IRS Code that allows employees to purchase health insurance and other ancillary benefits tax free. Premium Only Plan It is the intent that this plan shall qualify as a Section 125 plan of IRC as amended from time to time. FSA-Enrollment-Authorization Form This is a generic form call CPA Inc if you need information on your plan specs. To the extent provided in the Adoption Agreement the Plan provides for the pre-tax payment of premiums and contributions to spending accounts that are excludable from gross.

The Plan is intended to qualify as a Cafeteria Plan under Section 125 of the Code so that Optional. Ad Simple Legal Solutions in the Comfort of Your Home. Basic Business Plan Template 18 Free Pdf Format Download Free Premium Templates. Instantly Find Download Legal Forms Drafted by Attorneys for Your State. The Plan Document governs in the event of any discrepancy between these documents. Sounds good at first. In order to qualify for tax advantages a Section 125 plan must satisfy the requirements of Code Section 125 and underlying IRS as summarized below. The premium or HSA contribution is actually deducted before taxes are calculated. The statutory prohibition on. This document is intended as a.