Secured Loan Agreement Template Free Uk

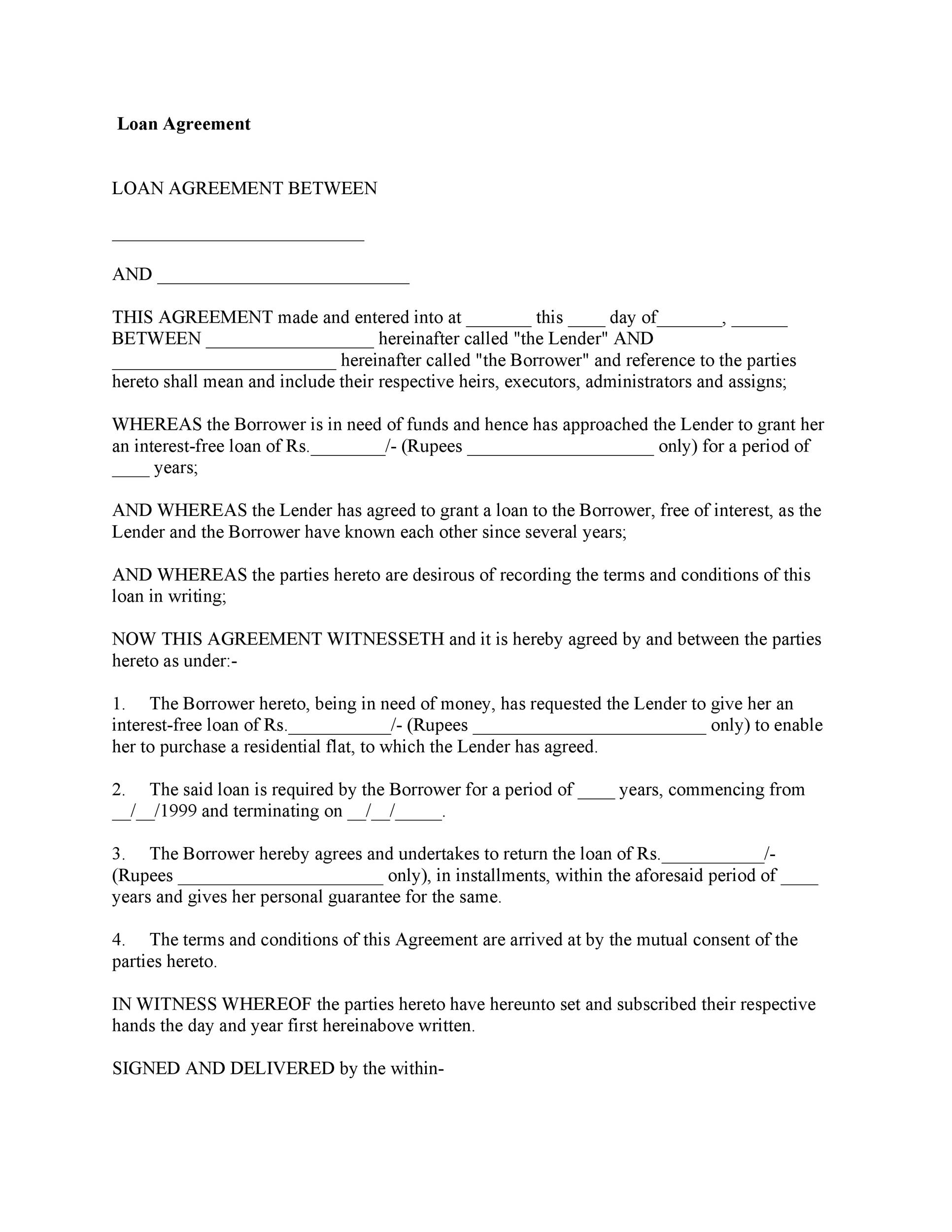

Secured loan agreement template free uk - Still having this type of document in writing benefits both the borrower and the lender. A shareholder or stockholder is lending money to its corporation. The loan is secured on the borrowers property through a process known as mortgage origination. The basic elements required for the agreement to be a legally enforceable contract are. If the borrower doesnt pay the lender can take the collateral. Or a corporation owes money to a shareholder or stockholder for salary etc and the parties need a record of the payment to the shareholder or. The maximum amount of the loan is some fraction of the resale value of the car. The note holds the borrower accountable for paying back the money under the agreed-upon terms. For example auto loans are usually secured. Repayment can sometimes be a big issue when it comes to loans as it requires trust and keen observation an assessment on whether a borrower is willing to pay the loan and if heshe is truly qualified for the loan.

Personal Financial Statement Form Samples - 7 Free Documents. A secured promissory note is used if personal property or real estate is collateral for the loan. It is easier for the company to provide permission with the trade reference as well as financial institutions. A lien provides a creditor with the legal right to seize and sell the collateral property or asset of a borrower who fails to meet the obligations of a loan or contract. Knowing the conditions within a loan agreement can help the lender be more secured that heshe will be repaid.

Family Loan Agreement Template Free Huuti

Knowing the conditions within a loan agreement can help the lender be more secured that heshe will be repaid. A business loan agreement especially when the borrowed money is supplementing or starting a business. If the borrower fails to repay the loan they will be in default and subject to seizure of their assets.

Show ImageFree Loan Agreement Template Make Yours In 3 Steps

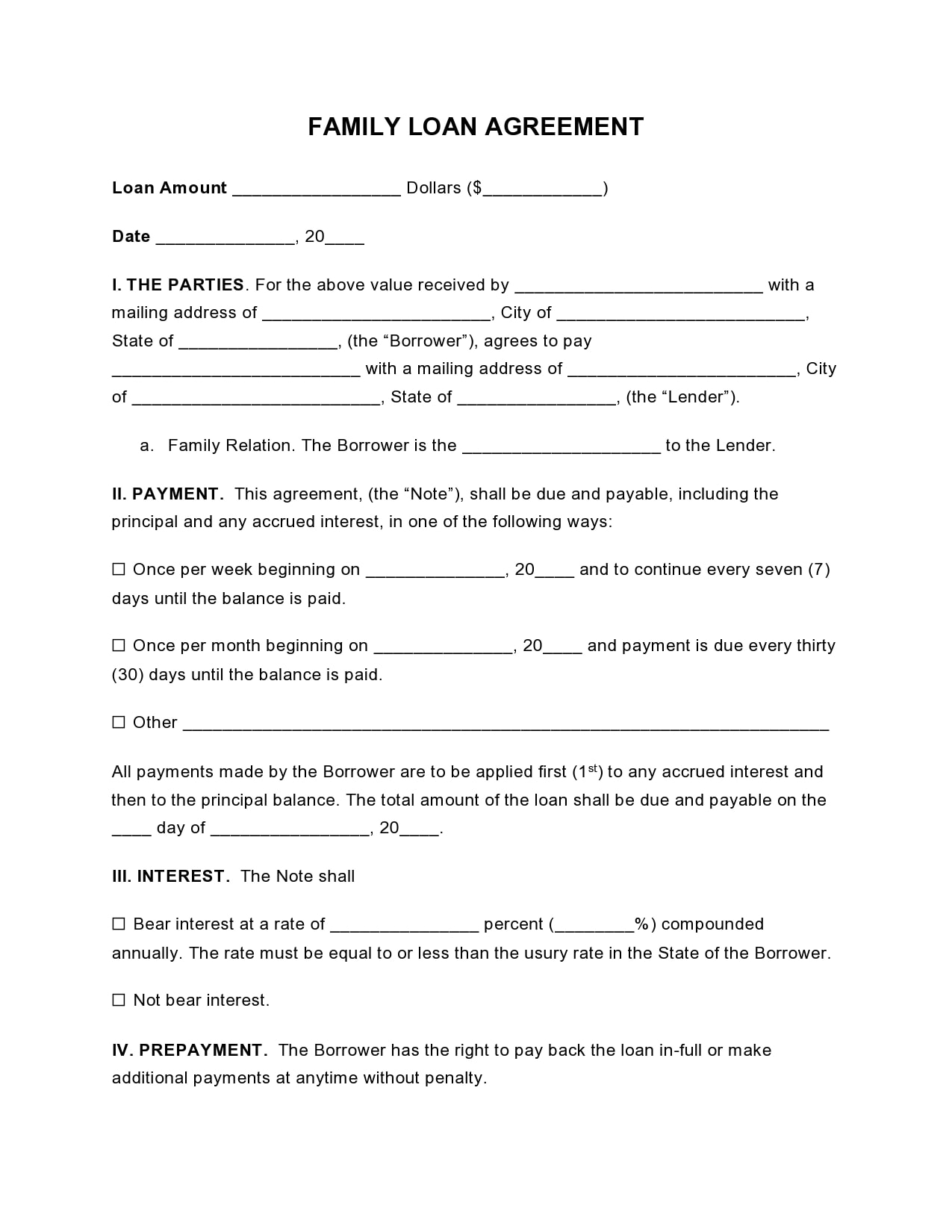

You can loan money to another member of your family if they need it. An agreement usually sets out the terms of the loan in particular the amount to be loaned the interest rate the dates and duration of the loan the frequency and value of repayments any collateral used to secure the loan and under what conditions you will be free to sell or take possession of the collateral. For example auto loans are usually secured.

Show ImageFamily Loan Agreement Template Free Huuti

A promissory note or promise to pay is a loan contract between a lender that agrees to lend money to a borrower to be repaid with interest. The property that is the. Use the Secured Promissory Note document if.

Show ImageLoan Agreement Templates Poster Template

The contract lasts for a specified period of time. For example you could receive a loan of 6000 with an interest rate of 799 and a 500 origination fee of 300 for an APR of 1151. A car title loan is secured by the borrowers car but are available only to borrowers who hold clear title ie no other loans to a vehicle.

Show ImageFree Loan Agreement Template Simple Personal Employee Family

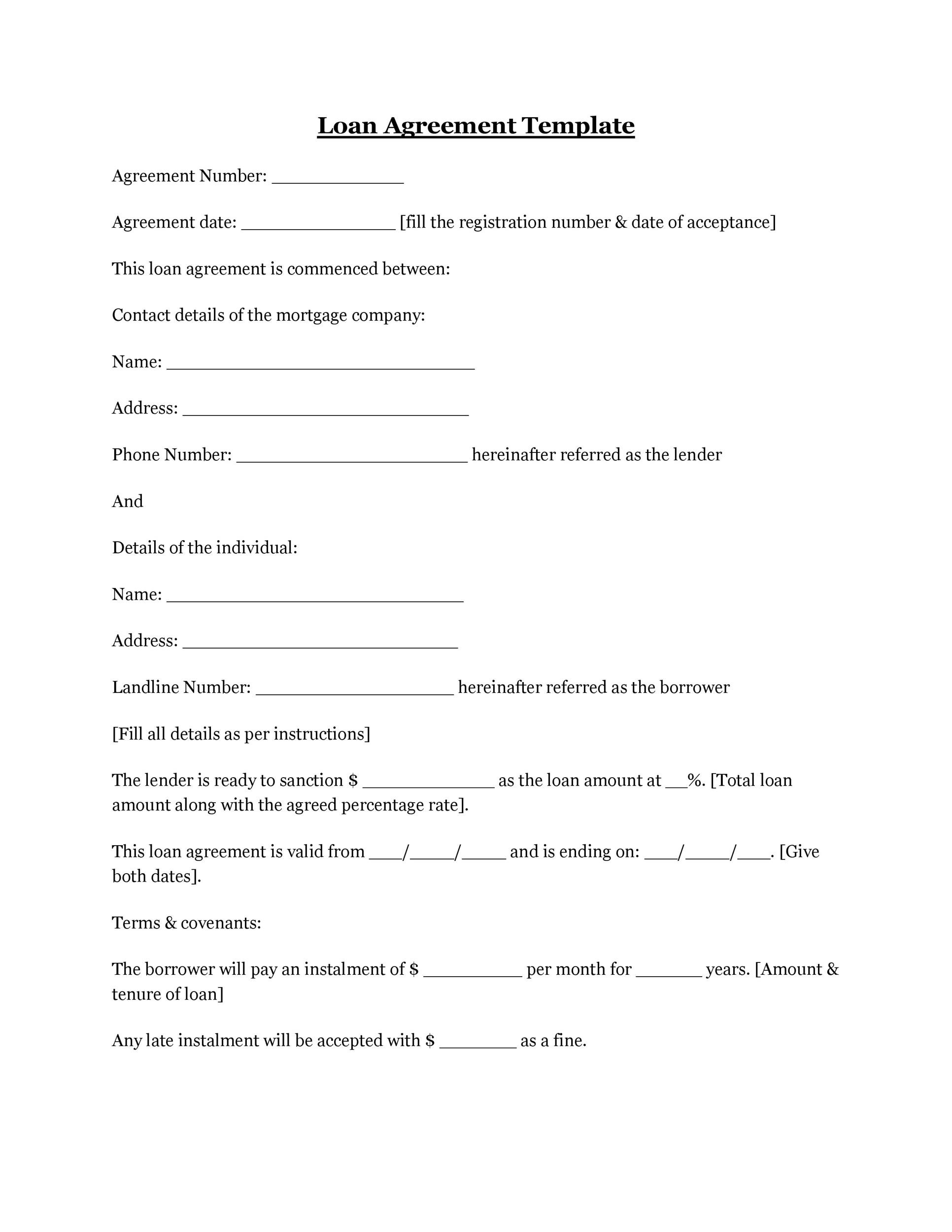

It should clearly state how borrower will make the payments. A bill of sale shows that full consideration has been provided in a transaction and that the seller has transferred all the rights to the property which was detailed in the bill of sale to the buyer. Loan Agreement Form Template.

Show ImageLoan Agreement Templates Poster Template

Promise to Pay or Promissory Note. Loan Agreement Form Example - 65 Free Documents in Word PDF. A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for repayment plus interest.

Show Image40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

For example auto loans are usually secured. A family loan agreement is a loan between members of a family. Still having this type of document in writing benefits both the borrower and the lender.

Show ImageFree Personal Loan Agreement Templates Word Pdf

Use a Loan Agreement for loans of a large amount or that come from multiple lenders. In some states element of consideration can be satisfied by a valid substitute. A Shareholder Loan Agreement also called a Stockholder Loan Agreement is used when a corporation is borrowing money from one of its shareholders or stockholders.

Show Image29 Simple Family Loan Agreement Templates 100 Free

In order for a contract to be enforceable it must contain certain legal conditions such as an offer and an acceptance of that offer. The date or timetable that the principal. The note holds the borrower accountable for paying back the money under the agreed-upon terms.

Show Image40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

A simple Loan Agreement should include the following. The loan is secured on the borrowers property through a process known as mortgage origination. 40 Printable Loan Agreement Forms.

Show ImagePromise to Pay or Promissory Note. 7 Home Appraisal Form Samples - Free Sample Example Format. An agreement usually sets out the terms of the loan in particular the amount to be loaned the interest rate the dates and duration of the loan the frequency and value of repayments any collateral used to secure the loan and under what conditions you will be free to sell or take possession of the collateral. In order for a contract to be enforceable it must contain certain legal conditions such as an offer and an acceptance of that offer. The property that is the. Credit Application Template authorizes the company for investigating the credit of the customer. An agreement between private parties creating mutual obligations enforceable by law. The note holds the borrower accountable for paying back the money under the agreed-upon terms. A promissory note or promise to pay is a loan contract between a lender that agrees to lend money to a borrower to be repaid with interest. Or a corporation owes money to a shareholder or stockholder for salary etc and the parties need a record of the payment to the shareholder or.

If the borrower doesnt pay the lender can take the collateral. Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender. In some states element of consideration can be satisfied by a valid substitute. Cassels acted for the underwriters. A Secured Promissory Note can help convince a lender to make a loan and ensures the borrower will pay it back by the due date. A Promissory Note only requires the signature of a borrower whereas the Loan Agreement should include signatures from both parties. A business loan agreement especially when the borrowed money is supplementing or starting a business. A similar credit facility seen in the UK is a logbook loan secured against a cars logbook which the lender retains. It is a legal agreement between partners binding them together to achieve a common program result through a defined strategy. The amount of money or principal that is being borrowed and whether interest or a percentage of the principal is also owed When.

You loan a certain amount of money to a person and you want your agreement in writing. A bill of sale is a legally binding document that shows in writing the sale or transfer of personal property from one party to another. The purpose of the loan doesnt matter and this loan doesnt require the services of a credit union bank or any other lending institution. The loan is secured on the borrowers property through a process known as mortgage origination. The date or timetable that the principal. A bill of sale shows that full consideration has been provided in a transaction and that the seller has transferred all the rights to the property which was detailed in the bill of sale to the buyer. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ is a loan used either by purchasers of real property to raise funds to buy real estate or alternatively by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. A Loan Agreement is more comprehensive than a Promissory Note Promissory Note and includes clauses about the entire agreement additional expenses and the process for amendments ie how to change the terms of the agreement. Still having this type of document in writing benefits both the borrower and the lender. If the borrower fails to repay the loan they will be in default and subject to seizure of their assets.